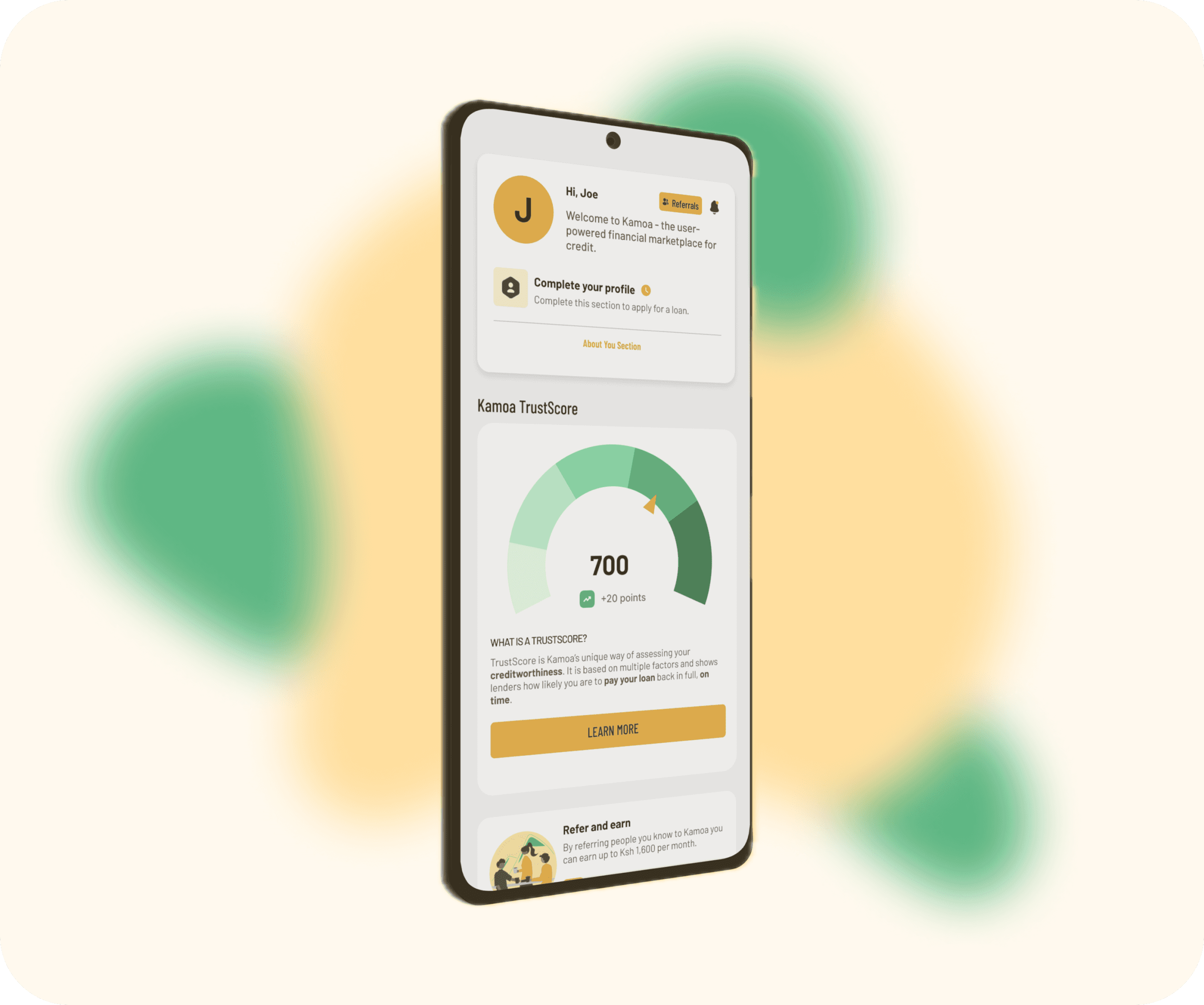

700

Flying high

Better Recommendations to Lenders

A high TrustScore increases the chance of receiving better recommendations for loans with favourable terms.

Personalised App Experience

The Kamoa app tailors the experience based on the user's TrustScore.

Higher Rewards & More Access

A high TrustScore unlocks access to a wider range of financial products and potentially higher rewards within the Kamoa ecosystem.

Who Benefits from TrustScore?

On top of benefiting the app users, the TrustScore also helps lenders make better informed loan application decisions.

Available on: